http://zerohedge.blogspot.com/2009/03/is-gs-tempting-interest-rate-black-swan.htmlThe thing to note, is that unlike both Citi and BofA, which actually are real consumer banks with a depositor base, Goldman is a consumer bank only in name (when is the last time you deposited your cash in a Goldman retail branch?). Consequently, BOA and C have total assets of $1.5 trillion and $1.2 trillion, both more than 10x the assets of GS, which is at $162 billion (and this excludes the incremental assets at the Bank Holding Company level for both BOA and C).

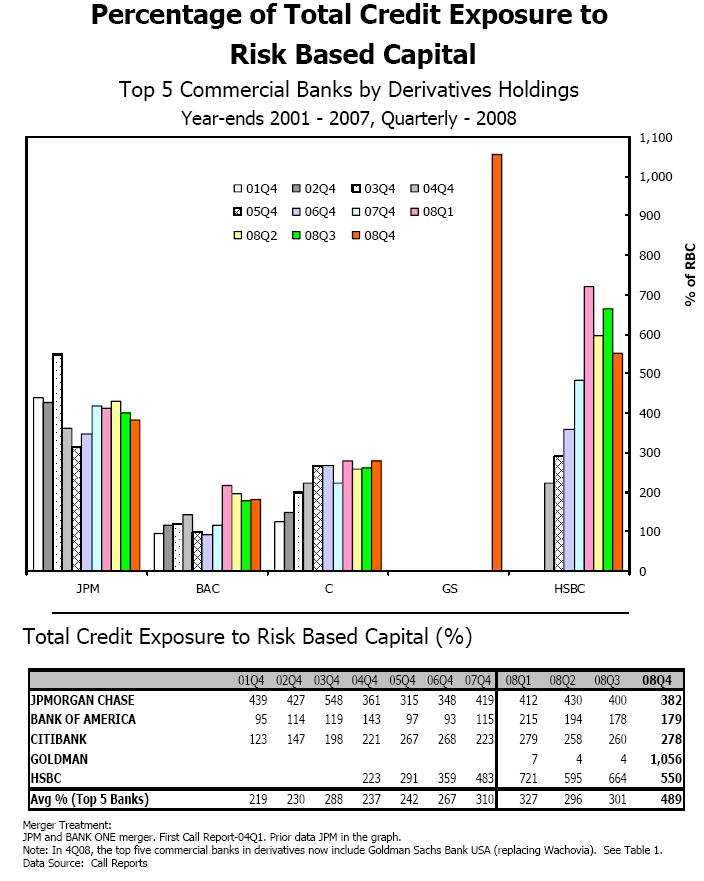

Has Goldman, in its pursuit to catch up with the imaginary PIMROCK decided to chew off a little more than its assets would allow? 1,056% more in fact? Or, alternatively, has the company bet a little too much in its bet that it can easily anticipate interest rate moves? As pointed out, over $160 trillion in Interest Rate contracts exist currently. What the credit crunch taught us is that the risk management of credit derivatives was woefully inadequate in a time when credit was flowing freely and the system was nice and liquid. After the bubble burst, certain entities (wink wink AIG) ended up having to commit capital to a sizable amount, more than half at times, of the total notional of derivatives the company had underwritten - a scenario previously never thought possible. And the massive reduction in global CDS notional outstanding over the past year and a half (from over $60 trillion to under $30 trillion today) has been a direct result of financial companies realizing they did not provision well enough for the "black swan" day, and thus rushing to unwind as much of these ticking time bombs as they could.

In the meantime, the interest rate black swan is growing. Do not misunderstand us: Zero Hedge has no idea what, if any, a black swan in Interest Rates may be. It is - by definition - an unexpected, unpredictable, outlier, aka fat-tail, event. Its prediction would immediately render it a grey swan at best, if not beige. However, instead of focusing so much on CDS as the financial system bogeyman, is it not time to look at some of these other derivative instruments that may soon plague the Basel I/II and whatever other risk consortia appear in the future. At $200 trillion in total derivatives, and $160+ trillion plus concentrated in Interest Rates, a fat tail event here, whether due to a paradigm shift in US monetary policy (that whole thing about Greenspan focusing on inflation instead of deflation now might raise a few eyebrows), or something totally different, even partial needs to satisfy these contracts will result in staggering and unmanageable repercussions to the global economy (tangentially, is it even physically possible to print $200 trillion in one year?)

Of course, as everything is smooth sailing in IR Swaps for now, I doubt anyone will even think about potential issues in this space... until it is too late.

Is Goldman Sachs tempting the interest rate black swan with 1056% risk exposure?

-

annarborgator

- Posts: 8886

- Joined: Sun Jun 17, 2007 5:48 pm

Is Goldman Sachs tempting the interest rate black swan with 1056% risk exposure?

No real recovery can happen until we stop idiocy like this, IMO:

I've never met a retarded person who wasn't smiling.